The dollar index is falling on Tuesday. Although it is worth noting that this decline does not look significant, and there are no special prerequisites for this, except that market participants are already preparing for Friday's US Department of Labor report with data on the state of the US labor market for November.

Last week, economists' forecasts suggested a decline in the NFP figure (30,000 new jobs created outside the agricultural sector) and a 3.6% unemployment rate. According to a recently updated estimate, the forecast was adjusted: the number of new jobs created outside the agricultural sector is expected to grow by 200,000, and the unemployment rate is at last month's level of 3.7%.

In this report, market participants pay special attention to the NFP indicator. In this case, the growth of 200,000, despite the relative decline of the indicator compared to the previous month, when 261,000 new jobs were created, is an acceptable indicator for the Fed, which indicates a rather stable condition of the American labor market. According to different estimates of economists, 150,000 new jobs should be added every month for the normal functioning of the US labor market.

Also, at the same time (1:30 PM GMT) on Friday, Statistics Canada will release a report with data on the country's labor market for November. Like for the Fed, the GDP, inflation and labor market data are determinants for the Bank of Canada in planning monetary policy parameters.

Declining unemployment rate is positive for the CAD. If the unemployment rate rises, the Canadian dollar will fall. And here is where there could be an unpleasant surprise for market participants and the Bank of Canada. The previous unemployment figures are 5.2%, 5.2%, 5.4%, 4.9%, 4.9%, 5.1%. The forecast is that the unemployment rate is expected to rise to 5.3% in November.

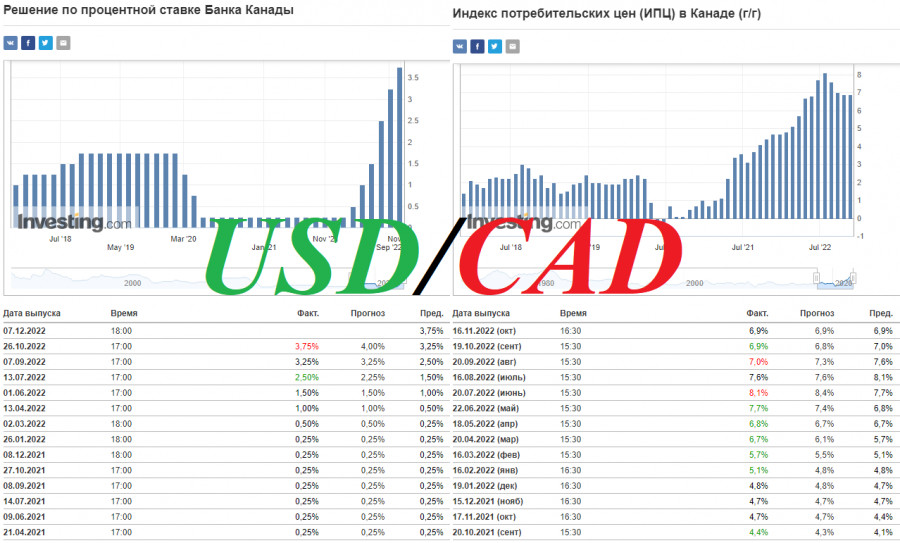

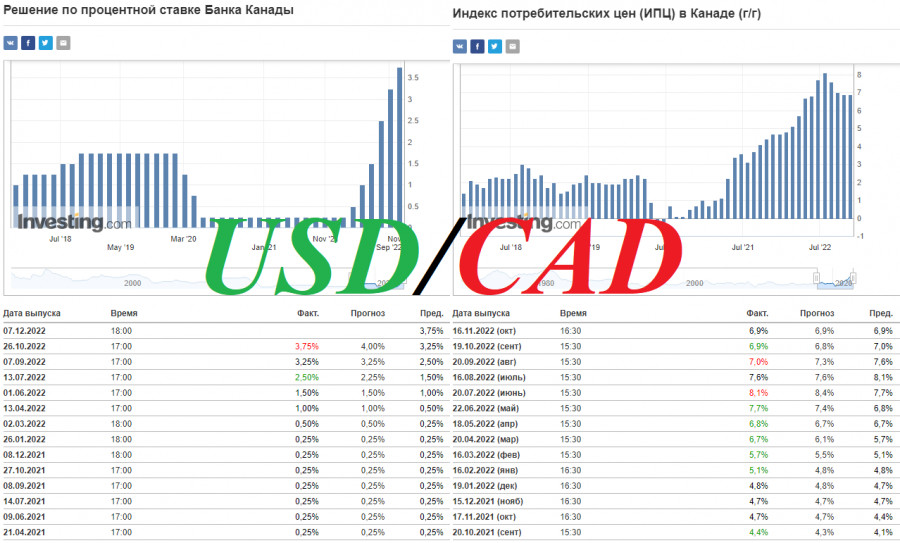

The Bank of Canada, like many other major global central banks that have taken the path of tightening monetary policy, is in a difficult situation—to curb the rise in inflation without harming the national economy. Inflation in Canada has accelerated to a near 40-year high (in February 2022, Canadian consumer prices rose 5.7% year-over-year after rising 5.1% in January to a 30-year high, 7.7% in May and 8.1% in June). This is the highest rate since early 1983. But in September and October it had already fallen to 6.9%. Even though the Bank of Canada's inflation target is in the 1%–3% range, it is clear that the central bank's tight monetary policy is producing positive results—inflation is declining.

And so, on October 26, the Bank of Canada unexpectedly raised its benchmark interest rate by 50 basis points (to 3.75%), although a 75 bps increase was widely expected. Bank of Canada governor Tiff Macklem said that bank leaders are nearing the end of the tightening cycle.

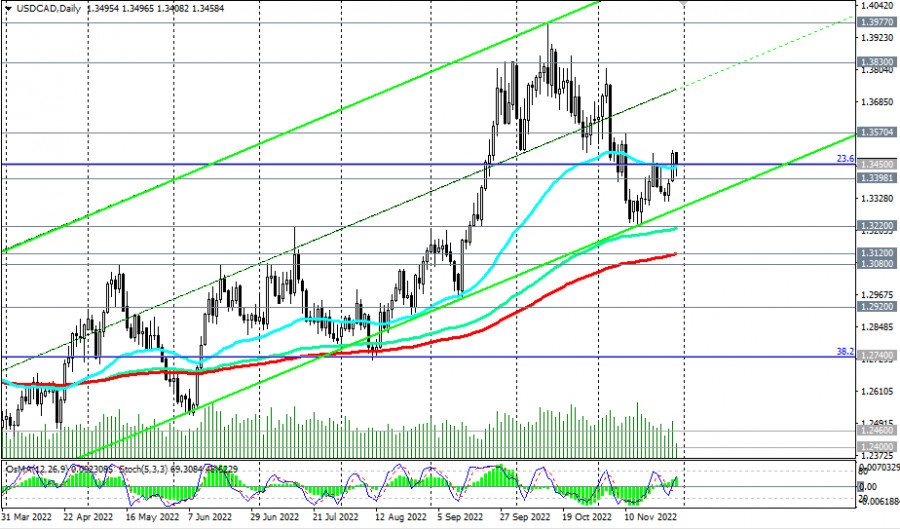

Such statements and the decision of the Bank of Canada disappointed market participants, and immediately after its announcement, the USD/CAD pair jumped almost 100 points from an intra-hour high of 1.3558, although then it turned back down against the background of a massive weakening of the US dollar observed in the first half of this month.

If the report of the Statistics Canada on the state of the national labor market really comes out with the disappointing data on Friday, we should expect the weakening of the Canadian dollar and the growth of USD/CAD pair given the drop in oil prices observed since the beginning of the month. Though, it is likely that the U.S. dollar will play a major role in its dynamics. What we can almost certainly expect from the pair USD/CAD this Friday is a significant volatility of the quotes, especially if the official data coming from the US Labor Department and the Statistics Canada will be much different from the forecasted values.

As of writing, the USD/CAD pair was trading near 1.3458, in the zone of important resistance levels. Considering the general upward dynamics of the pair, a break of these levels will open the way for it towards the recent local high at 1.3570.

Of the news today, which could dramatically increase the volatility of the pair, we should pay attention to the publication at 13:30 of Statistics Canada report with data on the GDP of the country and the Conference Board report on consumer confidence in the US for November. The American consumers' confidence in the country's economic development and in the stability of its economic position is a leading indicator of consumer spending, which accounts for a large part of the overall economic activity. A high level of consumer confidence indicates economic growth, while a low level indicates stagnation. The previous reading was 102.5. A rise in the indicator will strengthen the USD, while a decline will weaken the US dollar. On the whole, as we noted above, the USD/CAD remains upward.