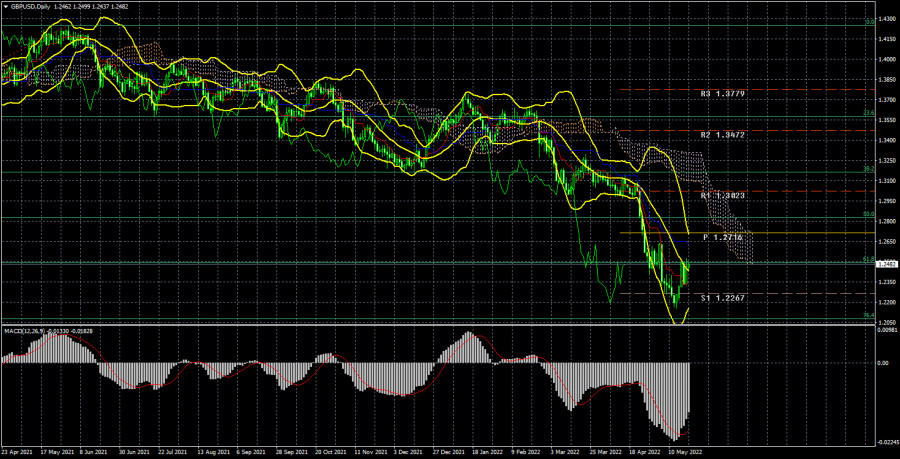

Long-term perspective.

The GBP/USD currency pair has increased by 240 points during the current week. As in the case of the euro currency, this is not too strong a growth, which is very clearly seen in the illustration above. That is, at the moment, we are talking again only about a pullback, which at any moment can transform into a new round of a downward trend. At the moment, the pair has not even managed to get to the critical line. Consequently, the position of the British currency remains very weak. The pound sterling still feels a little more confident than the euro currency. The pound is still under strong pressure due to its geopolitical background and fundamentals. But the macroeconomic background this week, we can say, provided support. Reports on unemployment, wages, applications for unemployment benefits, and retail sales were significantly better than forecasts. The only thing that spoiled the whole picture was the inflation report, which rose to 9% in the UK, which is already higher than in the US or the European Union. The saddest thing is that inflation rose at a time when the Bank of England raised the key rate four times. That is, it turns out that all the efforts of the BA were in vain. For example, in the United States, inflation slowed down by the end of April. The moment with further tightening of monetary policy by the Bank of England also remains unclear. After four increases, many experts believe that the British regulator will take a break. But how can we take a break if inflation next month at such a pace may rise to 10%? Thus, the dilemma. Plus, market participants themselves are actively getting rid of the pound, as COT reports have been signaling for several months in a row.

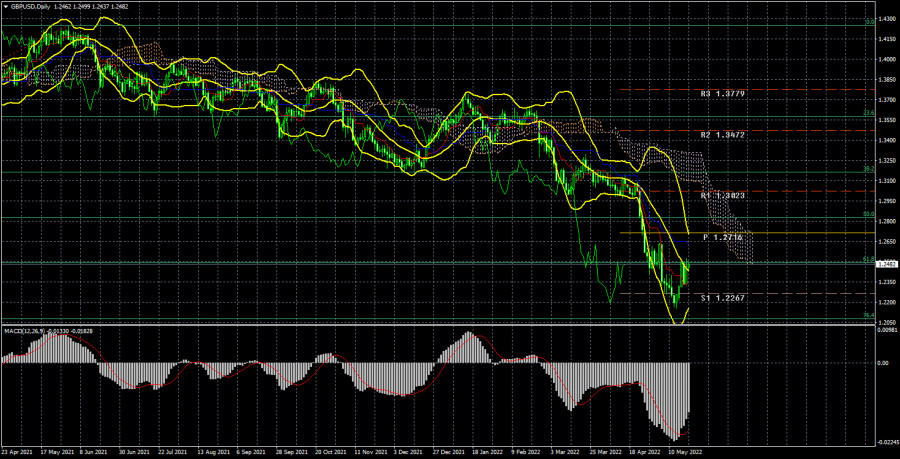

COT analysis.

The latest COT report on the British pound showed almost no changes. During the week, the Non-commercial group closed 2.8 thousand buy contracts and 3.2 thousand sell contracts. Thus, the net position of non-commercial traders increased by only 0.5 thousand. The net position has been falling for 3 months, which is perfectly visualized by the green line of the first indicator in the illustration above. Or the histogram of the second indicator. The Non-commercial group has already opened a total of 106 thousand sales contracts and only 26 thousand purchase contracts. Thus, the difference between these numbers is already more than fourfold. This means that the mood of professional traders is now "pronounced bearish" and this is another factor that speaks in favor of continuing the fall of the British currency. Note that in the case of the pound sterling, the COT reports data very accurately reflect what is happening on the market: the mood of traders is "strong bearish", and the pound has been falling against the US dollar for a very long time. We do not see specific signals for the end of the downward trend yet, but usually, a strong divergence of the red and green lines of the first indicator signals the imminent end of the trend and the beginning of a new one. Therefore, the conclusion is that an upward trend may begin in the near future, but it is dangerous to try to catch its beginning at the lowest point. The pound may well demonstrate another round of decline before starting to grow.

Analysis of fundamental events.

As we have already said, quite important reports were published in Britain this week that could support the pound. And what about the States? In the States, there was a weak report on retail sales and that's all. There was also a speech by Jerome Powell, from whom the market is not waiting for any new information right now. In general, several speeches by Fed representatives took place this week at once, and in each case, the functionary spoke about the need to continue to aggressively raise the rate. That is, the mood of the Fed monetary committee does not change and still assumes a tightening of monetary policy. Consequently, the US dollar remains secured by an important long-term support factor. Especially if the Bank of England takes a break for a few months. Of course, the market could have already worked out all future Fed rate hikes several times, since it has long been no secret to anyone that it is planned to increase it to 3.0-3.5%. However, no one can say with certainty that the market has already played this factor. Thus, the US currency can continue to grow against European currencies. And if the conflict between Ukraine and the Russian Federation escalates, or the conflict spills out of the territory of Ukraine, then risky currencies may collapse with a new force.

Trading plan for the week of May 23-27:

1) The pound/dollar pair has started a weak correction so far with the goal of the critical Kijun-sen line. So far, it is very early to talk about an uptrend, since the price is below all the lines of the Ichimoku indicator. A rebound from the critical line can be a strong signal for new sales with a target of 1.2076 (76.4% Fibonacci). The chances of strong growth of the British currency are still small.

2) The prospects for the British currency remain rather vague and so far there is no reason to buy the pound/dollar pair. We believe that it is simply impractical to buy a pair on such a strong downward trend, no matter how attractive the current levels look. We also believe that it will be possible to open long positions at least after fixing above Kijun-sen with the goal of Senkou Span B.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels - target levels when opening purchases or sales. Take Profit levels can be placed near them.Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts - the net position size of each category of traders.

Indicator 2 on the COT charts - the net position size for the "Non-commercial" group.